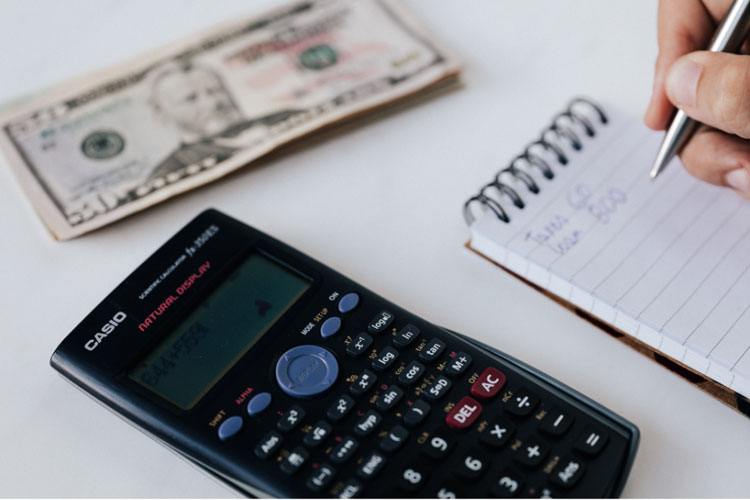

Let’s talk about something most parents think about… but don’t always say out loud.

“Are we saving enough?”

With rising grocery prices, tuition fees, utilities, and unexpected medical expenses, saving money in 2026 feels harder than ever. But here’s the truth:

Saving isn’t about a perfect number. It’s about having a plan.

So today, we’re breaking down how much a Filipino family should realistically save every month in 2026, depending on income level.

No pressure. No guilt. Just real numbers.

First: What Does “Saving Enough” Even Mean?

Savings should cover three things:

- Emergency fund

- Short-term goals (school, travel, repairs)

- Long-term goals (retirement, house, investments)

If you’re only doing #1 for now — that’s okay. Start there.

The Ideal Rule (But Adjusted for Filipino Families)

You’ve probably heard of the 50/30/20 rule:

- 50% needs

- 30% wants

- 20% savings

In reality? For many Filipino families, 20% feels impossible.

So here’s a more realistic 2026 version:

- 70–80% needs

- 10–15% wants

- 10–20% savings

Even 10% consistently saved is powerful.

Savings Guide by Income Level (2026)

Let’s get specific.

If Your Family Earns ₱50,000 per Month

Recommended savings target: ₱5,000 (10%)

Why 10%?

At this income level:

- Housing + food already take most of the budget

- School and utilities eat a big portion

- Emergencies can easily derail finances

Focus on:

- Building a ₱50,000 emergency fund first

- Keeping debt low

- Avoiding lifestyle inflation

Even ₱3,000–₱5,000 monthly is progress.

If Your Family Earns ₱80,000 per Month

Recommended savings target: ₱8,000–₱16,000 (10–20%)

This is the “breathing room” income level.

At ₱80k:

- You can save while still living comfortably

- Emergency fund builds faster

- Insurance and investments become realistic

Ideal breakdown:

- ₱8k emergency fund

- ₱4k investments

- ₱2k–₱4k sinking funds (school, travel, repairs)

Consistency matters more than amount.

If Your Family Earns ₱120,000+ per Month

Recommended savings target: ₱20,000–₱30,000 (15–25%)

At this level:

- Strong emergency fund should be priority

- Investments should start growing

- Retirement planning becomes urgent

This is where you shift from “survival savings” to “wealth building.”

How Big Should Your Emergency Fund Be in 2026?

Minimum target: 3–6 months of expenses.

If your monthly expenses are ₱60,000, you need:

₱180,000–₱360,000 emergency fund.

Sounds big? Don’t panic.

Start with:

- ₱20,000 mini emergency fund

- Then build gradually

Small steps win.

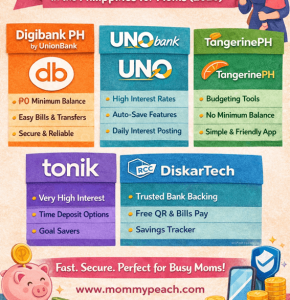

Where Should Families Keep Their Savings?

Split it smartly:

- High-interest savings account (for emergency fund)

- Digital banks with better interest rates

- Conservative investments once EF is complete

Avoid:

- Keeping everything in cash at home

- Putting emergency money in risky investments

Emergency funds should be accessible.

What If You Can’t Save 10% Yet?

Let’s be real. Some months are tight.

If 10% feels impossible:

- Start with 5%

- Or even ₱1,000 fixed monthly

- Automate transfers if possible

Saving is a habit before it becomes a big number.

Common Mistakes Filipino Families Make

- Saving “what’s left” instead of saving first

- Increasing lifestyle when income increases

- No emergency fund

- Using credit for non-emergencies

- Not discussing finances as a couple

Money conversations are uncomfortable — but necessary.

Sample Savings Breakdown (Family Earning ₱80,000)

Needs: ₱56,000

Wants: ₱8,000

Savings: ₱16,000

Savings allocation:

- ₱10,000 Emergency fund

- ₱3,000 Investment

- ₱3,000 Education fund

Simple. Clear. Doable.

Saving money in 2026 isn’t about being rich. It’s about sleeping at night without fear.

It’s about knowing that if someone gets sick, or something breaks, you won’t collapse financially.

Even small savings mean:

- Less stress

- More control

- More confidence

If you’re saving something — kahit maliit — you’re already ahead of many.

Start where you are. Adjust as income grows. And remember, financial peace is built slowly.