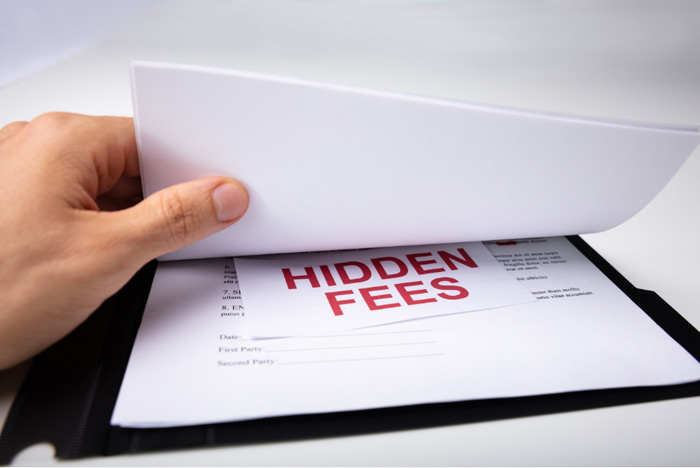

You finally found it — the dream house, the perfect neighborhood, and just the right budget. You’re already imagining family breakfasts on the balcony and cozy movie nights in your new living room. 🏠

But wait, momsh — before you sign those papers or get too excited about your Pinterest mood board, let’s talk about something that often surprises first-time homebuyers: the hidden costs of buying a house in the Philippines.1. Documentary Stamp Tax (DST)

This is one of the biggest surprise expenses for new buyers. The Documentary Stamp Tax is 1.5% of the selling price or zonal value, whichever is higher. It’s a legal requirement, so there’s no skipping this one.

💡 Example: If your house costs ₱2,000,000, the DST alone is ₱30,000 — ouch!

2. Transfer Tax

Another government-mandated cost. Transfer tax ranges from 0.5% to 0.75%, depending on your city or municipality. It covers the cost of transferring ownership of the property to your name.

💡 Tip: Always check with your local city hall for updated rates — they can vary!

3. Registration Fee

You’ll also pay a registration fee to the Register of Deeds to officially record the property under your name. This usually amounts to around 0.25% of the selling price.

4. Notary and Legal Fees

You’ll need a lawyer or a notary public to draft and notarize the Deed of Sale. This usually costs ₱5,000–₱10,000, depending on the property value and complexity of the documents.

💡 Pro tip: Always work with a reputable notary to avoid scams or errors in your documents.

5. Move-In and Utility Connection Fees

Once you get the keys, the spending isn’t over yet! Some developers charge move-in fees to cover inspections and security. You’ll also need to pay for water and electricity connections, which can range from ₱3,000–₱10,000 depending on the provider.

6. Home Insurance and Property Tax

Don’t forget to include annual property tax and home insurance in your budget. These may seem small, but they add up every year.

💡 Tip: PAG-IBIG and banks often require insurance coverage if your home is under a loan — make sure to include that in your monthly computation.

7. Furnishing and Renovation Costs

And then there’s the fun-but-pricey part — turning your new house into a home. Even basic furniture and appliances can easily reach ₱50,000–₱100,000, depending on your style.

You don’t have to do it all at once, though. Start with essentials: a bed, dining set, and basic kitchen tools. The rest can come little by little. 💖

Buying a home in the Philippines is more than just paying the price tag you see on the listing. These hidden costs can add 5–8% to your total spending — so it pays to plan ahead.

But don’t worry, momsh — knowledge is power. Now that you know what to expect, you can budget smartly, avoid financial stress, and enjoy that “finally, our home” feeling without surprises.