Being a mom in 2026 means juggling:

✨ Kids’ schooling

✨ Grocery price increases

✨ Bills and budgets

✨ Savings and emergency funds

✨ Insurance and investments

If there’s one thing that makes everyday finances easier, it’s having a digital bank that’s fast, secure, and mom-friendly.

No long lines.

No bulky paperwork.

No “banking only during office hours.”

Just easy, anytime banking with features that make your money work smarter.

Today, we’re breaking down the best digital banks in the Philippines for moms in 2026 — including pros, cons, fees, interest rates, and special perks.

Let’s dive in!

🔎 What Makes a Great Digital Bank for Moms?

Before we list the best ones, here’s what we looked for:

✔ No maintaining balance or low minimum

✔ High or competitive interest rates on savings

✔ Easy bill payments

✔ User-friendly app

✔ Link to wallets (GCash, Maya, etc.)

✔ Good customer support

✔ Security features (biometric login, encryption)

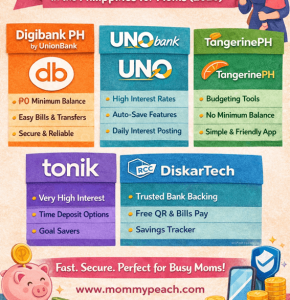

1. Digibank PH (by UBP / UnionBank)

Why Moms Love It

- No minimum balance required

- Easy bill pay + online transfers

- Link to e-wallets seamlessly

- Strong security features

Perks

- Occasional promos (cashback, disaster funds)

- Stable and reliable

Perfect for:

Busy moms who want simplicity + stability

2. UNObank – This is what I use personally.

Why Moms Love It

- Grows your money automatically

- Daily interest posting

- Auto-save features (round-ups, buckets)

Perks

- High interest on savings (compared to traditional banks)

- Easy automation tools to save without thinking about it

Perfect for:

Moms who want auto-pilot savings

3. Tangerine PH

Why Moms Love It

- Simple interface

- Competitive saving rates

- Great customer service

Perks

- Budgeting tools inside the app

- Bill pay + recurring transfers

Perfect for:

Moms who love simplicity + spending control

4️⃣ Tonik Digital Bank

Why Moms Love It

- High-interest savings accounts

- Time deposits with good rates

Perks

- Larger interest rates than traditional banks

- Lock-in savings options for goals

Perfect for:

Goal-oriented savers (emergency fund, tuition, house)

5️⃣ RCBC Digital / DiskarTech

Why Moms Love It

- Comes from a trusted bank

- Easy bills and QR payments

- In-app budget tracking

Perks

- Sometimes better promos if linked with RCBC branches

- Wide service integrations

Perfect for:

Moms who want digital simplicity + traditional bank backing

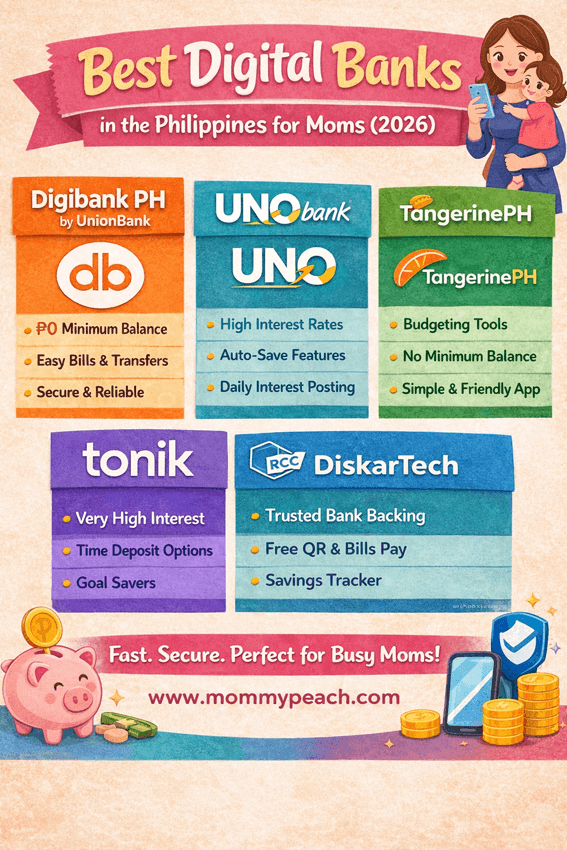

How These Digital Banks Compare (Quick Snapshot)

| Bank | Minimum Balance | Interest | Bill Pay | Auto-Save | Wallet Link | Best For |

|---|---|---|---|---|---|---|

| Digibank PH | ₱0 | Standard | ✔ | ❌ | ✔ | Everyday mom |

| UNObank | ₱0 | High | ✔ | ✔ | ✔ | Auto-savers |

| Tangerine PH | ₱0 | Competitive | ✔ | ✔ | ✔ | Budget lovers |

| Tonik Digital | ₱0 | Very High | ✔ | Optional | ✔ | Goal savers |

| RCBC Digital | ₱0 | Competitive | ✔ | ✔ | ✔ | Traditional + digital |

How to Choose the Right Digital Bank (Mom Checklist)

✅ 1. What’s Your Main Goal?

- Savings growth? — UNObank / Tonik

- Everyday simple banking? — Digibank PH / Tangerine

- Traditional backup? — RCBC Digital

✅ 2. Do You Want Auto-Save Tools?

If yes → pick UNObank or Tangerine PH

✅ 3. Are You Goal-Oriented?

For high target savings → Tonik Digital shines

✅ 4. Do You Sometimes Need Walk‐In Branch Access?

Then RCBC Digital gives you digital convenience + physical safety net

Tips Moms Should Know Before Opening a Digital Bank

💡 Use legit apps only.

Always download from Google Play / App Store.

💡 Link to GCash/Maya for faster transfers.

💡 Enable 2-factor authentication.

💡 Keep passwords safe — avoid storing them in notes.

💡 Check promo periods (banks often run cash bonuses for new users).

What About ATM Access?

Most digital banks offer free bank transfers via InstaPay or PESONet. ATM access may differ:

- Some provide free ATM withdrawal options

- Some partners require extra steps

- Always check the fee schedule

Moms’ Favorite Hacks to Boost Savings Using Digital Banks

📌 Auto Round-Up Savings

Set your bank to round up purchases to the nearest peso and save the difference.

📌 Destination Buckets

Create buckets for:

- Emergency fund

- School expenses

- Family travel

- Holiday gifts

📌 Auto Transfers

Every payday → transfer an automatic amount so savings happens first.

Real Talk: Don’t Let Fees Eat Your Savings

Some digital banks may have:

- ATM withdrawal fees

- Transfer fees (if outside the bank)

- Dormancy fees (rare, but check)

Always read the fee schedule before signing up.

Choosing a digital bank isn’t just about interest rates.

It’s about:

❤️ Financial peace

❤️ Less stress with bills

❤️ Easier savings habits

❤️ Growing money without overthinking

As a mom, every peso saved is one less thing to worry about.

Digital banking in 2026 is here to make your life easier — not more complicated.

And yes, you can master this, one app at a time.